what is suta tax rate for california

Tax rates for the second quarter range from 01 to 17. According to the EDD the 2021 California employer SUI tax rates continue to.

Solved If The State Of California Raised The Average State Chegg Com

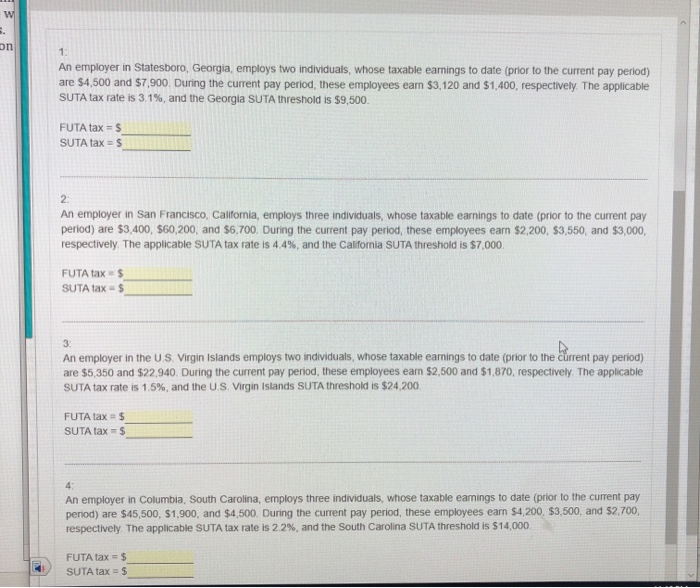

What is the FUTA and SUTA tax.

. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. The new employer SUI tax rate remains at 34 for 2021. As a result of the ratio of the California UI Trust Fund and the total wages paid by all.

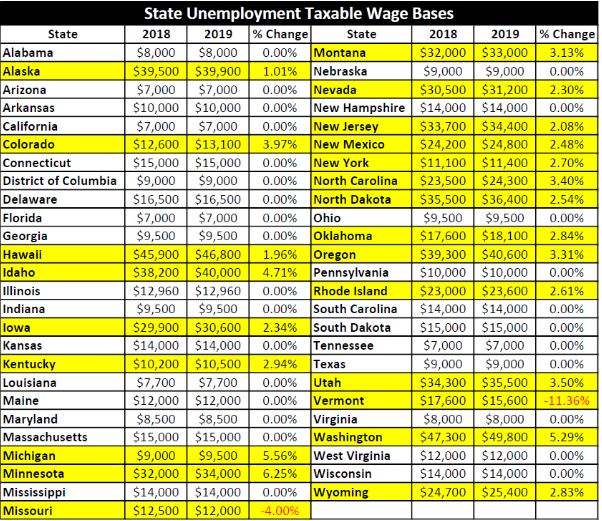

The SUI taxable wage base for 2021 remains at 7000 per employee. No guidance yet. SUI tax rate by state.

Arizona California Florida Georgia and Tennessee had the lowest wage bases at 7000. California PIT is withheld from employees pay based on the Employees Withholding Allowance Certificate Form W-4 or DE 4 on file with their employer. There is no taxable wage limit.

Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. Effective January 1 2022. The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers.

What is the SUTA tax rate for 2021. Generally states have a range of unemployment tax rates for established employers. When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the.

State unemployment tax rates. State SUTA new employer tax rate Employer tax rate range SUTA. The SUTA program was developed in each state in 1939 during.

SUTA or the The State Unemployment Tax Act SUTA is a payroll tax paid by all employers at the state level. 2021 SUI tax rates and taxable wage base. New Hampshire has raised its unemployment tax rates for the second quarter of 2020.

The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website. Your state will assign you a rate within this range. The states SUTA wage base is 7000 per employee.

SUTA dumping is a tax evasion scheme where shell companies are set up to get low UI tax rates. For example the wage base limit in California is 7000. Here is a list of the non.

Llc Tax Rate In California Freelancers Guide Collective Hub

California Wants To Double Its Taxes National Review

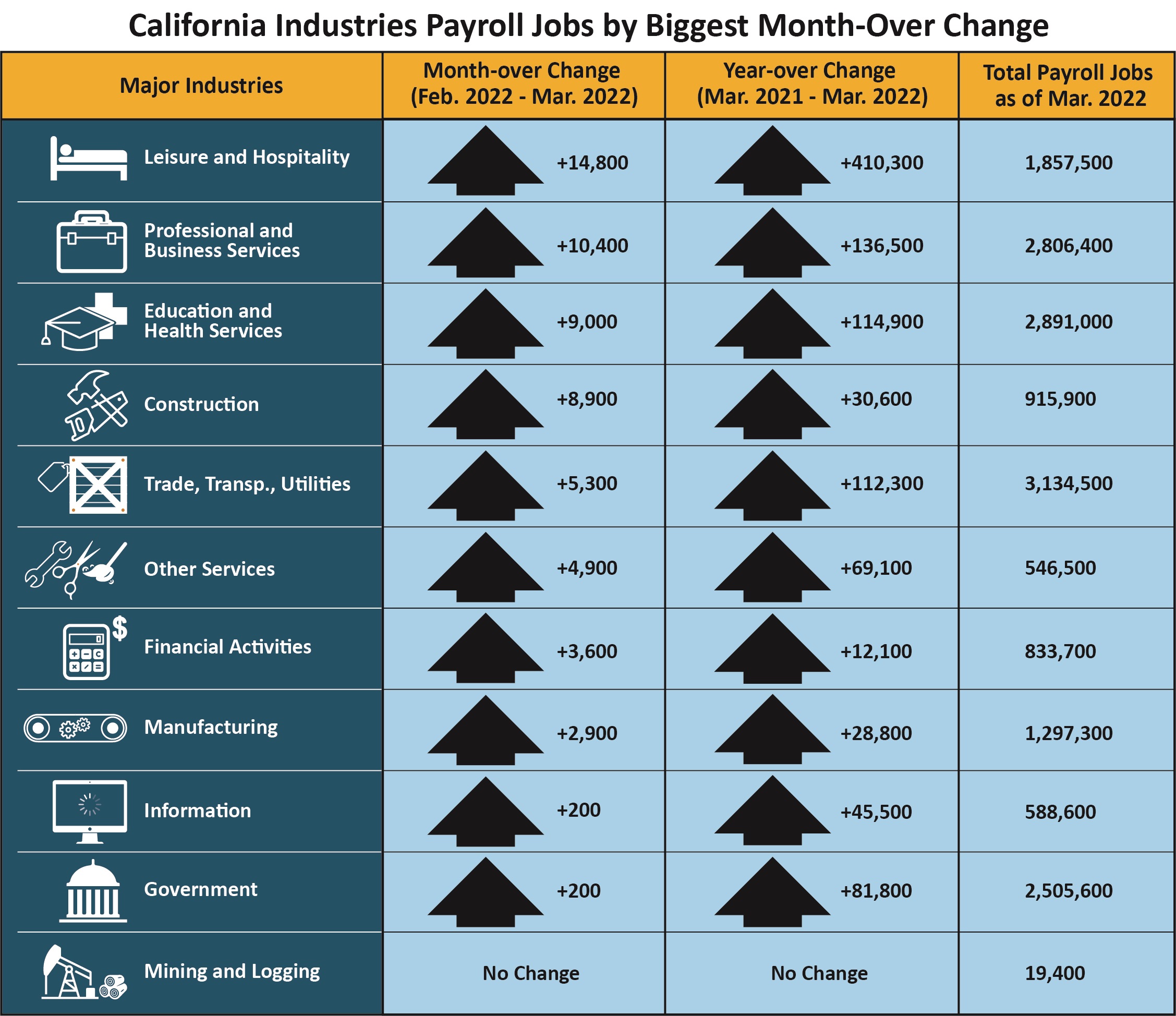

California S Unemployment Falls To 4 9 Percent For March 2022

Does Quickbooks Automatically Adjust Employer Payroll Tax Rates At The Beginning Of A New Year Newqbo Com Not Affiliated With Intuit Quickbooks

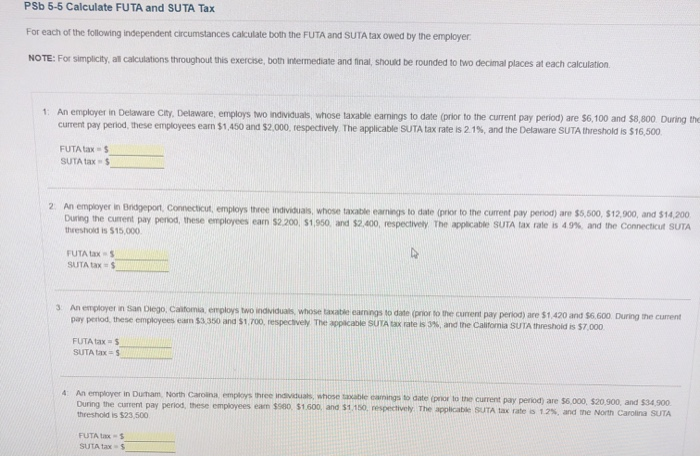

Psb 5 5 Calculate Futa And Suta Tax For Each Of The Chegg Com

How Do State And Local Severance Taxes Work Tax Policy Center

The Income Gap Unemployment And Tax Rates Visual Ly

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

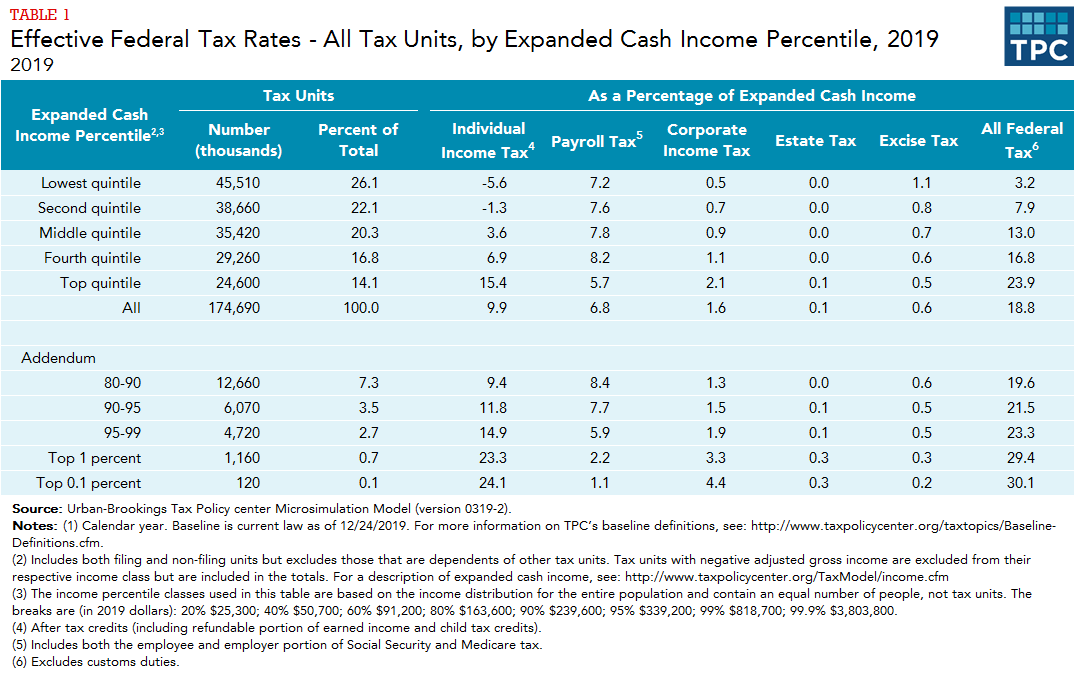

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

California Unemployment Rate 2021 Statista

California Corporations Pay Far Less Than Nominal Tax Rate Orange County Register

2022 Suta Taxes Here S What You Need To Know Paycom Blog

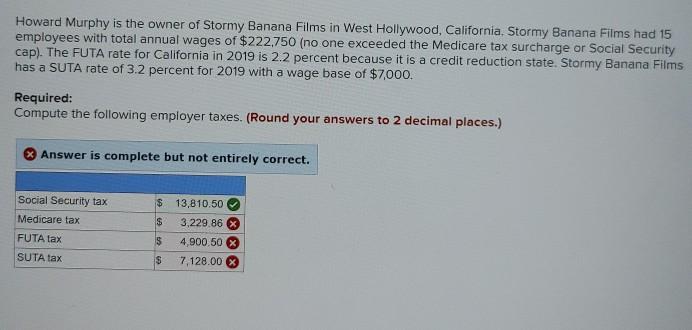

Howard Murphy Is The Owner Of Stormy Banana Films In Chegg Com

California State Tax H R Block

2022 Suta Taxes Here S What You Need To Know Paycom Blog

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Suta Tax Your Questions Answered Bench Accounting